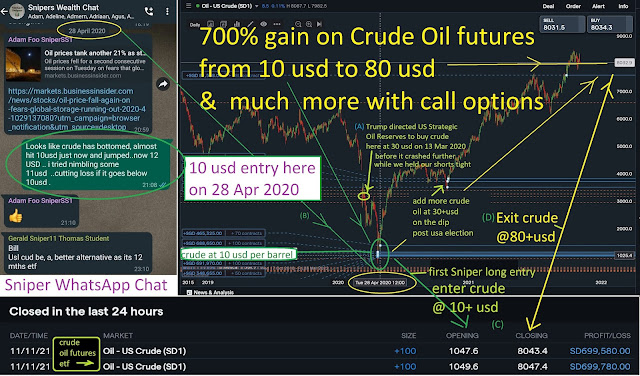

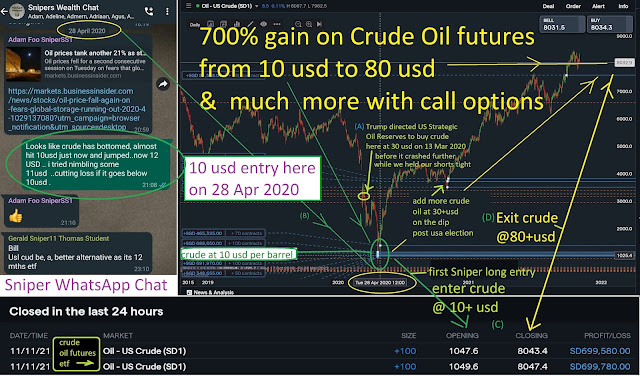

"28 April 2020 - Crude Oil at 10 USD per barrel " - that's the screaming news headlines on that fateful date ( see the date stamp on Sniper Wealth Chat in WhatsApp on above pic - left window ) when i told the Snipers to go grab every barrel of crude oil near above $10 they can find..

I expected a multi-bagger ride out of this oil grab at these rock bottom prices never to be seen again. What a wild x8 bagger ride we rode inexorably to the $84 peak recently.

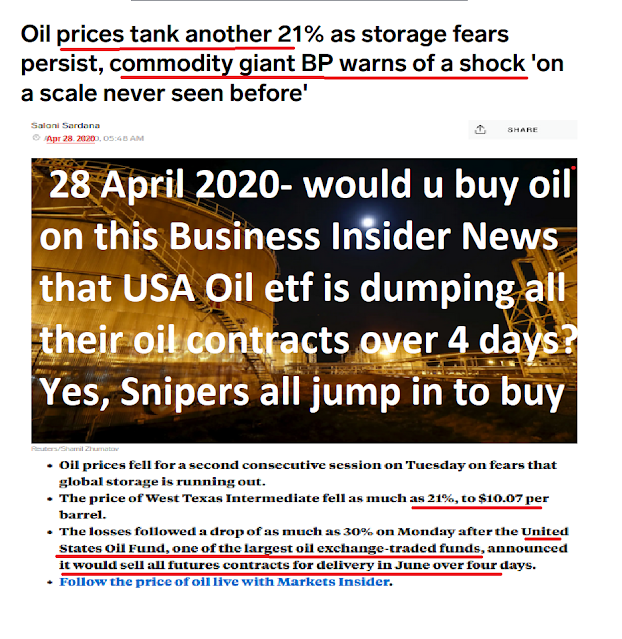

On that fateful day, the media was deluged with end of the world scenarios for crude oil prices from oil majors and top oil analysts alike ( see pic below for an excerpt on that day's news )

See above pic for the chart on the epic price rally that ensued from that 10+ usd that we entered ..

See above pic also for entry and exit prices executed & % profits earned reflected at the bottom window of above pic at note C ( note the etf prices have two extra digits than the WTI crude futures as the etf is transacted at 100 barrels per share )

Some snipers who are options fans went in for the leveraged kill with crude call options which brought even much more returns than the mere 700% unleveraged returns of the etf .

Looking back ... In that pandemic bottoming process of crude oil , many people who entered long much earlier and at higher prices than we did , lost their savings and got heavily indebted ( see the unfortunate people who got wiped out on Bank of China investment products linked to crude futures ) while our Snipers adroitly steered clear of catching the crude oil falling knife until it really bottomed out on 22 and 28 April 2020 .

Why did the experienced market gurus or bottom pickers jumped in earlier with bravado at say 30 USD before the relentless crash to zero & then negative prices ? Well , all thanks & no thanks to Trump , read on ...

A false floor to a falling knife : On 13 Mar 2020 , many market gurus made a fatal clarion call that killed their followers for good. That day, Trump directed the US strategic petroleum reserves ( "SPR" ) to buy up crude oil in huge quantities , apparently at 30-33 usd on that day's crude price ( see pic above note A and chart below from CNBC video screenshot ) .So these gurus told their followers to front-run on Trump's strategic oil purchase , to jump in to catch the crude oil at 30 USD thinking it has bottomed out on Trump SPR backstop move. Little did they know US crude oil May futures will continue to crash , in fact to zero and then to historic negative prices 5 weeks later .

If we had blindly acted on the Trump directive to SPR to buy crude at 30 usd before it crashed further to negative 5 weeks later , we would be licking our wounds on margin calls and not have the precious bullets left to buy crude when it really hit bottom to form a base at 10 USD from which it rallied big time and in which we took full advantage of in our epic ride to 80 USD from 10 USD

On hindsight , it looked all so easy to catch this falling knife at the pandemic bottom and ride the mutli-bagger to peak. but when you see the sorry suffering losers scattered everywhere in this cautionary tale of an epic multi-bagger trade, it would be wise to pause and reflect on why only a select few survive and prospered ( attend our free webinar to find out why ! ) while most got wiped out and never to recover .